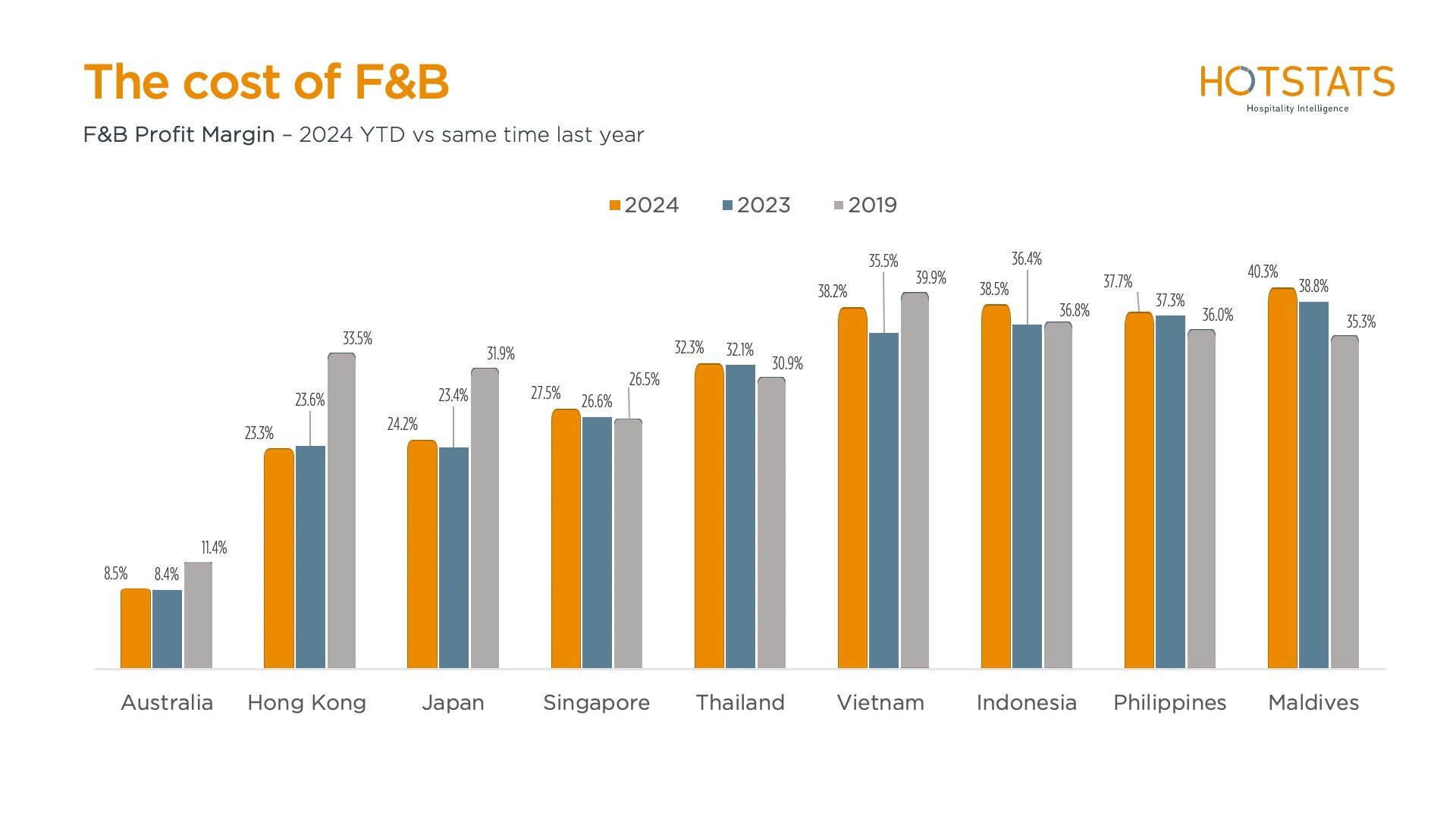

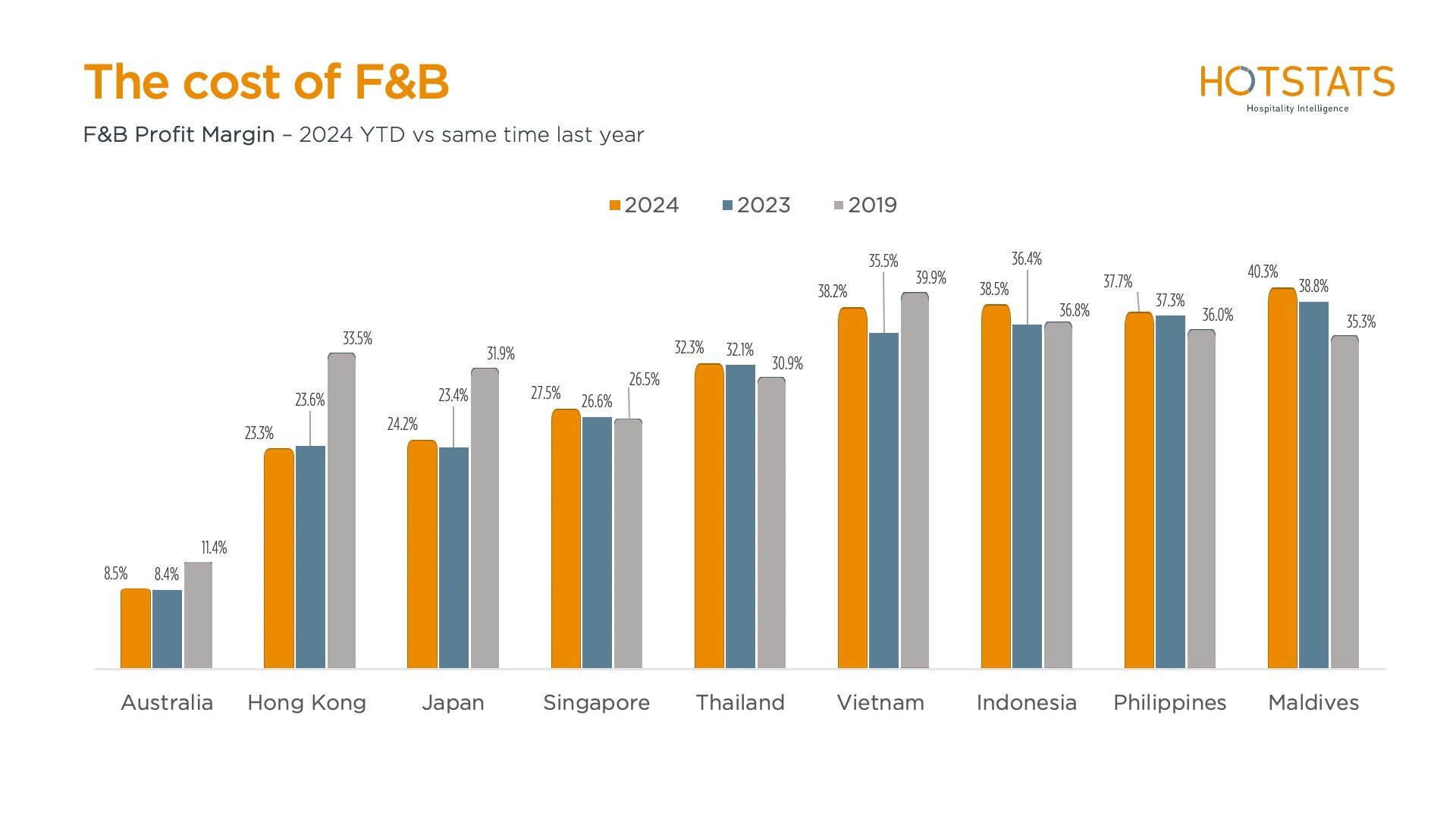

As 2024 progresses, the Food & Beverage (F&B) sector in Asia shows signs of steady recovery, offering a glimpse of strategic opportunities for investors and hotel operators. A detailed comparison of profit margins from 2019, 2023, and 2024 year-to-date (YTD) reveals critical trends in key markets across the region.

Marginal Gains Signal Stability in Australia. The country’s F&B profit margins have edged up from 8.4% in 2023 to 8.5% in 2024, reflecting a stable market. While the margin increase is slight, consistency suggests that the sector is on firm footing. Investors may see this as a signal of reliability in a market that has weathered the post-pandemic storm well.

Challenges persist in Hong Kong and Japan. The two countries in contrast to Australia, present a less optimistic picture. Both markets have seen their profit margins stagnate or decline compared to pre-pandemic levels. Hong Kong’s F&B margin remains flat at 23%, while Japan’s margin slightly increased to 24%, yet both are far below their 2019 levels. This suggests that recovery in these regions may be slower, requiring cautious optimism and perhaps a more long-term investment approach.

Vietnam and Thailand continue to be bright spots in the region. Both countries show strong and stable profit margins, with Vietnam at 38.2% and Thailand at 32.3% in 2024. These figures are consistent with or even exceed their 2019 levels, signaling recovery and growth. For hotel operators and investors, these markets represent significant opportunities for expansion and investment.

Singapore and Indonesia have demonstrated gradual but steady improvements in their F&B profit margins. Singapore’s margin rose from 26.6% in 2023 to 27.5% in 2024, while Indonesia’s margin increased to 38.5% in 2024. These trends suggest that both markets are on a positive trajectory, making them attractive for those looking to capitalize on growth potential in Southeast Asia.

The Philippines and the Maldives show signs of stability, with F&B profit margins holding steady. The Philippines saw a slight increase to 37.7%, while the Maldives experienced a modest rise to 40.3% in 2024. This stability is a positive indicator for these markets, suggesting that they have navigated the recovery phase effectively and are now positioned for future growth.

The overall picture of F&B profit margins in Asia highlights a region in recovery, with varying degrees of progress across different markets. Focusing on these markets with strong recovery signals could yield substantial returns even while maintaining a cautious approach in regions requiring more time to stabilize. This strategy positions stakeholders to capitalize on the ongoing recovery and future growth in Asia’s dynamic hospitality industry. As the F&B sector continues to rebound, strategic investments in the markets that show strong recovery signals could yield substantial returns while remaining cautiously optimistic about other markets which may require more time to stabilize, positioning stakeholders to benefit from the ongoing recovery and future growth in Asia’s hospitality industry.

By Bouserrind Comson, Director of Hotel Intelligence – APAC, and Jeannette King, Marketing Manager at HotStats